Building structures and delivers trusted property data so assets can be evaluated, financed, and transacted with less friction and greater confidence.

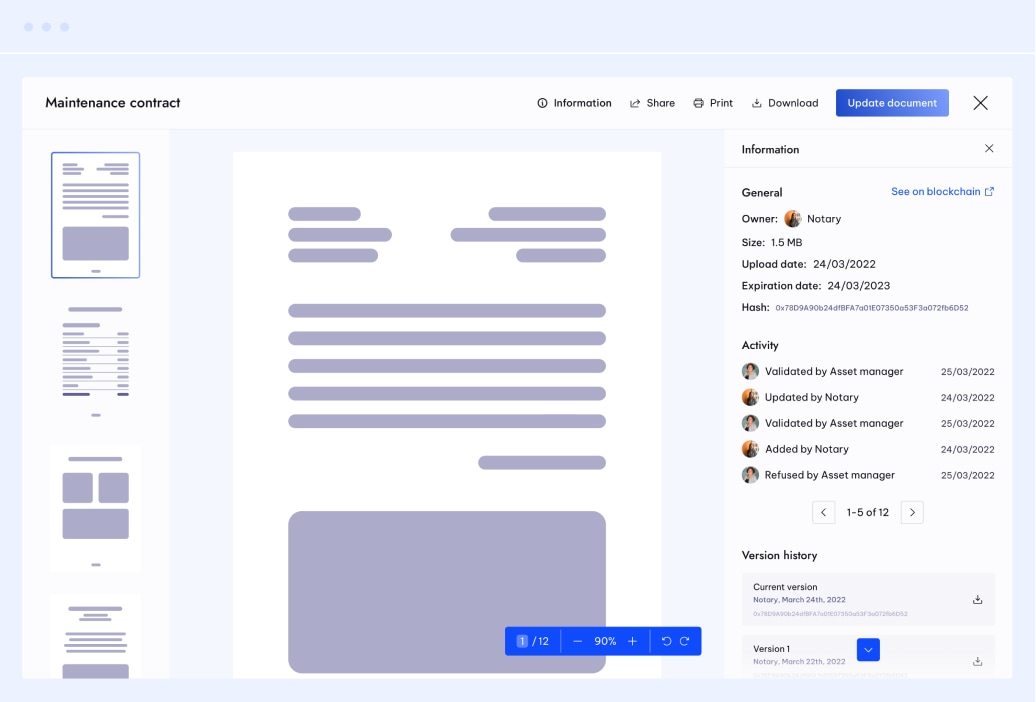

Structured, continuously maintained records reduce repetitive due diligence and help stakeholders focus on what has changed.

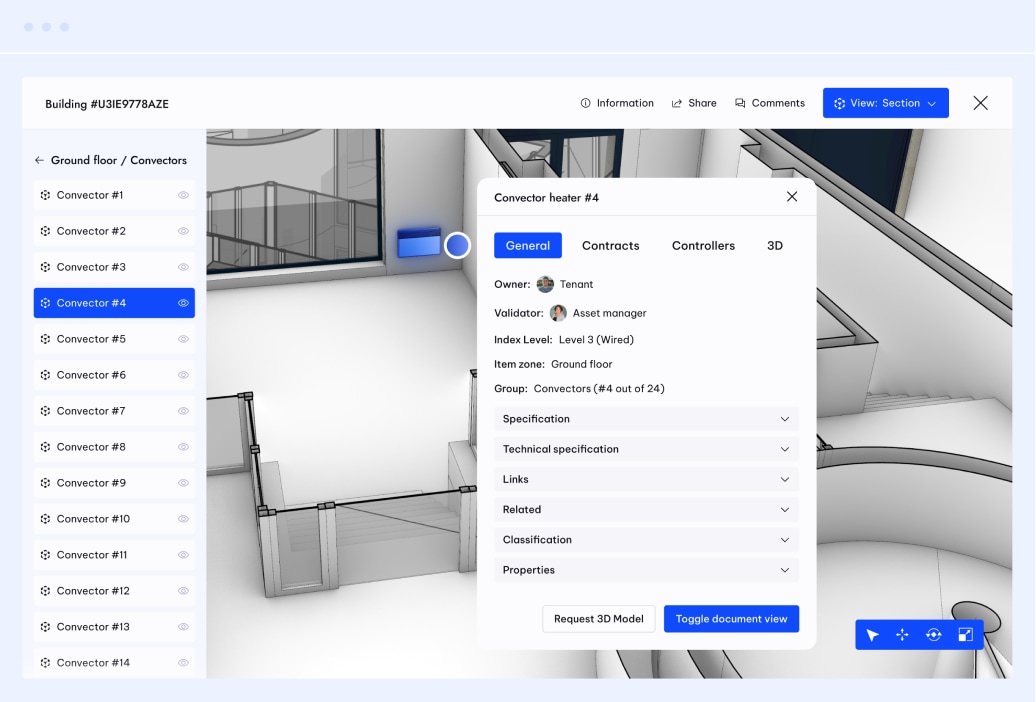

Connected property data gives stakeholders a clearer, more current view of an asset and supports informed decisions.

Finance-ready assets are easier to evaluate, underwrite, refinance, or prepare for tokenization and capital markets.

Traceable, audit-ready documentation supports compliance, reduces uncertainty, and builds confidence across the asset lifecycle.

Sign up for Building’s quarterly newsletter for insights, case studies, and partnerships shaping real estate.

Create a persistent Asset Record with complete and structured documentation.

Reduce appraisal and underwriting friction with structured, current data.

Anchor data on-chain and connect to tokenization and issuance platforms.

Interact with licensed partners and markets using better-prepared assets.

We prepare property data for compliance and tokenization, helping assets meet the requirements of modern capital markets.